To Successfully Trade Cryptocurrency: A Comprehensive Guide

To successfully trade cryptocurrency and aim for profits exceeding $1,000 a day, it’s essential to grasp certain foundational concepts and employ a straightforward yet effective trading strategy. Emphasizing the importance of consistency over high-risk ventures, this approach demonstrates how smaller, incremental gains can accumulate into substantial daily earnings.

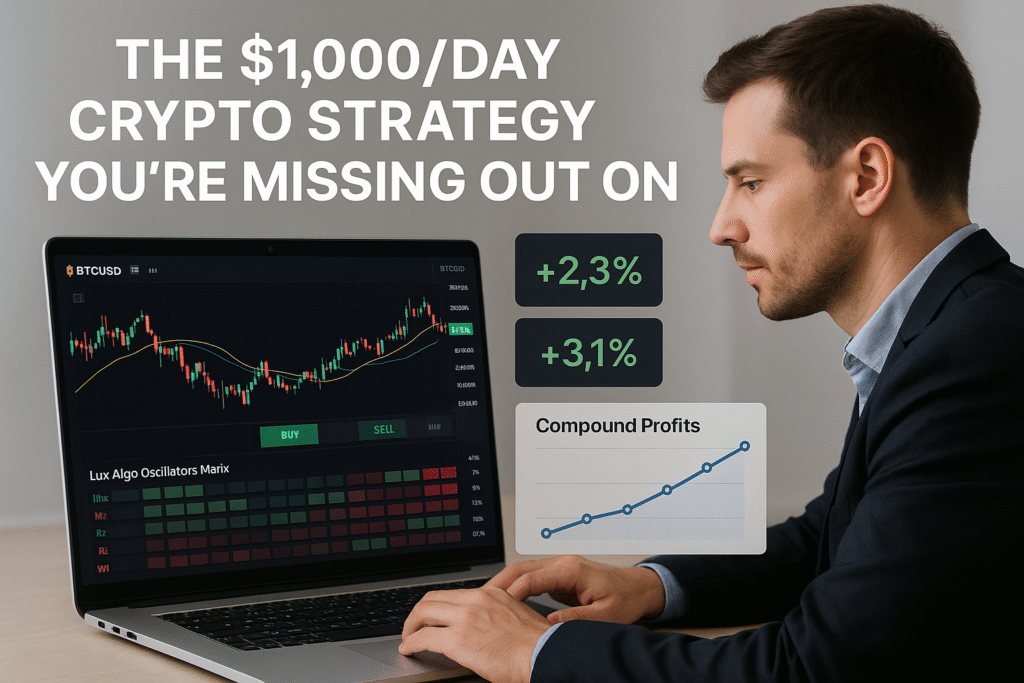

Initially, you’ll need three vital resources: a trading platform, a TradingView account, and an indicator plugin called Lux Algo. This indicator integrates with TradingView and provides essential tools for informed trading decisions. Lux Algo is widely regarded, trusted by over 50,000 users, and offers flexible subscription options, including monthly or annual plans with significant discounts.

The core of this trading strategy revolves around executing a method that may seem less attractive but enhances your trading skill regardless of your experience level. It’s a foundational lesson that the more you trade, the more you can potentially earn. For example, with a $10,000 trading account, a 1% market increase yields $100, while a 1% increase in a $100,000 account results in $1,000. Thus, starting with a larger account enhances earning potential, but it’s crucial to note that even a smaller account can grow significantly with the right strategy.

Even beginners with little to no knowledge of technical analysis can engage in this trading method, although acquiring basic technical analysis skills is advisable for future development. The common theme throughout trading is that the more you learn, the more you earn.

When utilizing Lux Algo, particularly the Oscillator Matrix, you’ll notice it provides buy/sell signals based on market trends. A recommended approach is to enter trades upon observing a “green dot” on the 15-minute chart, focusing primarily on the lower-end signals and avoiding mid-range entries. This technique involves the fundamental strategy of buying on dips and selling into upward movements, typically within a gain range of 1.5% to 3%. Consistently banking these gains, approximately 2% on average, can lead to substantial profits in the long run, particularly if you scale up your trading capital.

For context, let’s explore the power of compounding small gains. If you begin with a $1,000 investment, executing 10 trades each resulting in a 2% profit would increase your capital to $1,218. While that seems marginal, continuously employing this strategy can lead to significant results over time. For instance, if you made 100 successful trades at 2%, you could hypothetically grow your account to approximately $7,000 from an initial $1,000. Moreover, with 365 trades in a year, that could yield an extraordinary $1.3 million – underscoring the profound impact of compounding profits.

Importantly, this method recognizes that the market doesn’t depend on best prices for entry or exit; rather, it offers a consistent approach to locking in profits regardless of market volatility. The trade does require a decisive all-in, all-out strategy, trading your entire amount at once rather than incrementally investing. Results can vary; understanding this, it’s essential to trade only with amounts you can afford to lose while always approaching the market as a potential profits generator rather than fixating on timing the highs and lows.

In conclusion, while utilizing the Lux Algo Oscillator Matrix for trading, developing technical analysis skills can exponentially enhance your trade management, allowing you to recover from minor losses and strategically time your trades. By cultivating a repetitive, disciplined approach to locking in small gains, you can begin to see impressive results over time, creating a viable path toward significant financial achievements in trading cryptocurrency. Plus, remember to choose a trading exchange with low fees to avoid unnecessary costs that could erode your profits. Ultimately, your focus should always remain on maximizing your profits rather than minimizing costs, allowing for greater opportunities in the fluctuating cryptocurrency market.

The Essentials for Successful Cryptocurrency Trading

To successfully embark on your cryptocurrency trading journey, three critical tools are indispensable: a trustworthy trading platform, a TradingView account, and the Lux Algo indicator. Understanding the significance of each of these tools will provide the confidence needed to establish a solid groundwork for effective trading practices.

Firstly, having a reliable platform to trade cryptocurrency is crucial. The reliability and user experience of the platform you choose can influence your trading outcomes. Look for platforms that are well-reviewed, provide adequate security, and have a user-friendly interface.

Secondly, setting up a TradingView account is essential. TradingView is a versatile charting tool that helps traders analyze price action and make informed decisions. Once you subscribe to Lux Algo, you will receive instructions on how to integrate it with TradingView. This integration allows you to use advanced tools that enhance your trading capabilities, such as the Lux Algo oscillator Matrix, which is a key feature I rely on for my trades.

The Lux Algo indicator is particularly pivotal, as it provides buy and sell signals derived from market data. Through its customizable settings, traders can tweak the parameters to fit their trading styles. For instance, I primarily focus on entering trades when I see a Green Dot on the 15-minute chart, particularly from the lower end of the price range, as this indicates a potential opportunity to buy on dips and sell into strength for consistent gains—typically aiming for 2% to 3%.

As you familiarize yourself with these tools, it’s worth noting that trading is a process of learning and adapting. Even if you start with limited knowledge of technical analysis (TA), diving into the basics is beneficial. The more you learn, the more you earn. For beginners, focusing on crafting a disciplined strategy around locking in small, consistent gains can yield significant results over time, especially when leveraging the effects of compound interest.

Lastly, it’s important to choose an exchange that offers low trading fees, as these can add up when making frequent trades. However, while fees are a consideration, your focus should primarily be on the profits made through strategic trading. By consistently executing the strategies enabled by these tools, your trading account can grow substantially over time, regardless of the size of your initial investment.

Understanding the ‘2% Strategy’

The ‘2% strategy’ is a disciplined trading approach focused on capturing small, consistent gains. This strategy is particularly adept for those venturing into cryptocurrency trading, as it emphasizes steadiness and calculated growth, rather than risky speculation.

To begin using the ‘2% strategy,’ it is essential to have the right tools. You will need a cryptocurrency trading platform, a TradingView account, and the Lux Algo indicator, which assists in trade decision-making. Lux Algo is a powerful tool used by many traders, offering features such as the oscillator matrix and buy/sell signals, which can inform your trading strategies effectively.

A central tenet of this method is to understand how much you can stand to gain—or lose—based on your trading capital. For instance, a 1% market move on a $10,000 account results in a $100 profit, while on a $100,000 account, that same 1% yields $1,000. This illustrates the critical concept: the more you trade, the more you can earn.

When starting, even those who know little about technical analysis can succeed by gradually familiarizing themselves with basic concepts. It’s important to remember, the more you learn, the more you’ll earn.

Once you have your tools in place, the trading process follows a simple methodology. This involves looking for buy signals—indicated by a green dot on a 15-minute chart from the Lux Algo oscillator matrix. A key strategy is to focus on buying during lower price ranges and sell into strength for consistent gains, typically ranging from 1.5% to 3%.

For beginners, it’s recommended to avoid trading on margin. Instead, aim for a consistent 2% gain on each trade. For example, if your account is $10,000 and you make ten trades at 2% each time, it might seem unremarkable compared to simply buying and holding an asset that increases by 20%. However, this strategy emphasizes the power of compounding. By entering and exiting trades frequently, profits can accumulate to exceed what would typically be achievable through longer-term holding.

To illustrate, making 100 trades at 2% could potentially grow your $1,000 account significantly more than a single 200% gain could. Such repeated trading can amplify earnings over time dramatically due to compounding effects. If you managed to make 365 trades a year, starting from a $1,000 account, your balance could grow to approximately $1.3 million by simply locking in these small gains each day.

The essence of the ‘2% strategy’ revolves around developing a disciplined trading habit—one that focuses on consistently securing profits, treating the trading environment not as a venue for speculation but rather as a machine for generating income through thoughtful execution of the plan. The strategy helps manage emotions and fosters an encouraging mindset, as traders learn to be content with their 2% gains.

While it’s important to be aware of trading fees—especially since frequent trading could incur higher costs—many traders find that the profits from successful trades far outweigh these costs. The focus should not be on the fees but on the overall gains generated through strategic execution.

Ultimately, the ‘2% strategy’ is not just about achieving significant multiple returns quickly, but about cultivating a sustainable habit of growth that can lead to exponential results over time.

Trading Basics: Start with the Right Mindset

When embarking on your trading journey, especially in the fast-paced world of cryptocurrency, it’s crucial to cultivate the right mindset. This mindset focuses on incremental learning and consistent practice, allowing beginners to develop their trading skills and gradually build confidence.

The first step in this journey is understanding that there are essential tools and platforms required to trade successfully. Beginners should start by selecting a reliable trading platform, setting up a TradingView account, and utilizing an indicator plugin, such as Lux Algo. Lux Algo is beneficial because it provides various tools, including the Oscillator Matrix, which helps traders identify entry and exit points effectively. This approach ensures you have a structured foundation upon which to build your trading knowledge.

One key principle to remember is that the goal isn’t to become an overnight success in trading but rather to develop a skill set that will serve you over time, regardless of market conditions. It’s vital to grasp that the more you trade, the more you stand to gain. For instance, trading with smaller accounts may seem disadvantageous at first, but by practicing with a proper strategy, traders can learn to transform smaller investments into significant profits. As you begin trading, you don’t need to have extensive knowledge of technical analysis (TA); many traders start as complete beginners and learn as they go. The crucial takeaway is: the more you learn about trading and TA, the more you can earn.

A simple yet powerful strategy for beginners is the “2% strategy,” which focuses on compounding small gains consistently. This method allows traders to aim for an average gain of 2% per trade. Let’s consider an example: if you start with a $1,000 investment and successfully execute multiple trades, locking in 2% profits each time, you’ll find that these small gains can compound into substantial profits over time. For instance, completing 100 trades at 2% can surprisingly yield much more than simply holding a single asset for a higher percentage increase.

Trading should also be viewed as a skill or craft that involves understanding loss management and emotional control. Expect to encounter losses; every trader does. The secret is to leverage these experiences for growth by analyzing what went wrong and learning to make better decisions in future trades. Over time, this repetition will build your practice and intuition, leading to a more refined trading approach.

The use of tools like the Oscillator Matrix can aid immensely in helping traders decide when to enter and exit trades. These signals guide your trading decisions and can simplify the process of locking in profits consistently. Remember, it’s less about timing the market perfectly—many traders fail at that—and more about recognizing patterns that provide opportunities for profit.

Ultimately, as you delve into trading, keep in mind the concept of compounding and how critical it is to celebrate and secure your profits, even if they seem small in the beginning. Prioritize consistency and strategy over the expectation of massive, quick payouts. Start slow, build your knowledge base one step at a time, and reinforce your skills by practicing regularly. Over time, as you master the basics of technical analysis and develop your trading strategies, you will find that your confidence—and your trading account—will grow significantly.

Leveraging the Lux Algo Oscillator Matrix

Setting up the Lux Algo Oscillator Matrix in TradingView is a straightforward process that can significantly enhance your trading strategy. To begin, you need three essential components: a cryptocurrency trading platform, a TradingView account, and the Lux Algo indicator plugin. Lux Algo is highly regarded within the trading community, trusted by over 50,000 users, and can be subscribed to on a monthly or annual basis. For those new to trading, starting with a monthly subscription is advisable, progressing to an annual plan to save on costs.

Once you subscribe to Lux Algo, you’ll receive instructions on how to integrate it with your TradingView account. To activate the oscillator matrix, navigate to the indicators section in TradingView, click on “Invite Only Scripts,” and select the Lux Algo Oscillator Matrix. This will bring up a chart at the bottom of your TradingView interface, which is crucial for identifying entry and exit points in your trades.

The primary function of the Lux Algo Oscillator Matrix is to signal entry points via color-coded indicators on the 15-minute chart. The key signals to look for are the green dots, which indicate buying opportunities. However, it’s important to focus on lower-end green dots while ignoring those at mid-range, as they tend to provide the strongest signals. Once a green dot appears, you buy on the dip. The strategy emphasizes selling into strength, typically aiming for a consistent gain of 1.5% to 3% per trade. For instance, if you’re leveraging a smaller account, aim for around 2% gains, and if trading with leverage, consider using a low multiplier of 3x to 5x.

This “2% strategy” can lead to compounding profits over time. For example, if you start with an investment of $1,000 and successfully execute 10 trades at a 2% gain each, you could see your balance grow significantly due to the reinvestment of profits. This strategy’s power really shines when considering larger scales of trading, showing exponential growth as you accumulate a larger sum through repeated gains.

Despite the apparent simplicity of the 2% strategy, it’s essential to understand that not every trade will be successful, and losses will occur. Successful traders learn to handle these losses and adopt a mindset that keeps them focused on execution rather than the pain of a setback. It is important to maintain emotional discipline, knowing that each closing of a trade, successful or not, is part of an overarching strategy designed for long-term growth.

Ultimately, what distinguishes the Lux Algo oscillator matrix is its ability to facilitate entry and exit points without the need for extensive technical analysis knowledge. Although understanding some technical indicators and concepts can aid in strategy execution, the oscillator matrix provides accessible signals that can be utilized by both beginners and experienced traders alike. Regularly entering and exiting trades based on this matrix allows for the accumulation of small, consistent gains, which, over time, can lead to substantial returns. Always remember, the trading environment is fluid, filled with opportunities to capitalize on—focus on locking in those 2% gains consistently, and your trading account will likely show considerable improvement over time.

Executing Trades: Timing and Execution

Successfully entering and exiting trades in the cryptocurrency market requires a strategic approach, with a focus on timely execution and swift profit-taking. One effective method involves using an indicator called the Lux Algo, specifically its oscillator matrix, which helps identify optimal buying and selling moments. The tactic revolves around identifying lower-end green dot signals on a 15-minute chart, which indicate a good time to enter a trade.

To apply this method, it’s essential to first set up your trading tools properly. You will need a platform to trade on (like Binance or Coinbase), a TradingView account, and the Lux Algo indicator installed. This tool provides incredibly useful signals and overlays that can help you predict market movements based on price action.

When you see a green dot appear on the lower end of the price range, that is your cue to buy. This is often during market dips, where substantial price increases follow. Unlike mid-range green dots, which might indicate less reliable buying opportunities, lower-end signals tend to present the best potential for locking in gains.

Once you’ve entered a trade after buying at these lower-end signals, the next step is to determine when to sell. The goal here is to capitalize on market strength, aiming for smaller, consistent gains—generally around 2-3%. For beginners and those trading without leverage, aiming for profits within this range is advisable. If trading on leverage, lower levels such as 3x to 5x are recommended for risk management, allowing you to exit once you hit your 2-3% target.

The strategy is built around the consistent execution of these small trades. For instance, if you start with a $10,000 account, achieving just a 2% profit on each trade can accumulate significantly over time due to the power of compound interest. With 100 trades at 2% profit each, rather than simply hoping for a 2X or 3X return on a single asset, you could multiply your initial investment exponentially.

Consider an example: Starting with $1,000, if you conducted 10 trades at 2%, you could end up with $1,218 instead of just holding your asset for a 20% rise. If you increase this to 100 trades, each at 2%, your capital could grow to $2,724 instead of merely doubling to $2,000 through a single investment. Over the course of a year, making 365 trades at 2% could skyrocket your account to over a million dollars, demonstrating the effectiveness of this method.

The essence of this trading approach is to view the market not merely in terms of buying low and selling high but as a consistent money-making machine. The key is not about timing the absolute highs or lows of the market but rather capitalizing on the continuous fluctuations between them. This philosophy promotes a consistent lock-in of gains, enhancing emotional discipline as traders learn to be content with smaller, more regular profits rather than chasing larger, riskier returns.

It’s important to note that while utilizing this strategy, you may not catch every trade due to the nature of market activity, which can often occur at inconvenient times. Nonetheless, thousands of opportunities will arise that will allow you to buy and sell profitably if you are attentive.

As you gain experience, it becomes crucial to develop additional technical analysis skills. While the Lux Algo can help guide you, understanding various chart patterns and indicators can enhance your trading decisions even further. Familiarize yourself with one pattern or indicator at a time, slowly building your trading arsenal.

Moreover, when implementing this trading strategy, ensure that you use exchanges with low fees, as high transaction costs can erode the profits gained from frequent trading. Focus on maximizing your earnings and do not dwell on the costs of trading; the profits will significantly outweigh the fees if you stick to the 2-3% gain strategy diligently.

By mastering timing and execution through this systematic approach, you can increase your trading efficacy and potentially see dramatic growth in your capital over time.

Compounding Gains: The Power of Repeated Success

In the world of cryptocurrency trading, the concept of compounding small gains can lead to extraordinary results over time. By focusing on achieving consistent 2% gains and leveraging repeated trades, traders can outperform traditional holding methods significantly. This strategy not only provides a clearer pathway to profit but also cultivates essential trading skills.

One of the first points discussed is the effectiveness of the 2% strategy. This approach involves entering a trade whenever a specific trading indicator—like the green dot from the Lux Algo oscillator—signals a buying opportunity on a 15-minute chart. Ignoring less favorable mid-range signals allows traders to concentrate on lower-end green dots, which represent potentially stronger buy levels. The key takeaway is to buy during dips and sell into strength, consistently aiming for small increments—typically 2% gains on each trade.

To put this into perspective, let’s consider a scenario with $1,000. If this amount is traded 10 times for a 2% gain each time, the total profit would realistically become approximately $1,218 over those trades. While some might argue it’s better to simply hold onto an asset until it appreciates significantly, this trading strategy capitalizes on compounding gains through consistent trading.

As the number of trades increases, so does the potential profit from these small gains. For example, making 20 trades at 2% each could lead to a profit of around $485, while 50 trades could result in approximately $1,691. The numbers illustrate the power of compounding: executing 100 trades at a consistent 2% gain could grow an initial $1,000 investment to about $2,724—far exceeding what would be earned from merely holding the asset.

The exponential growth potential becomes even more prominent when considering a full year of active trading. If a trader were to execute 365 trades at a 2% gain per trade starting from $1,000, the total balance could skyrocket to an astonishing $1.3 million by year-end. Scaling this with a larger starting amount—like $10,000—could potentially inflate the account to over $13.7 million through the same method.

What sets this strategy apart is not just the numerical outcomes but its psychological aspect. Traders learn to focus on locking in smaller profits rather than waiting indefinitely for larger returns, which encourages consistent engagement with the market. It shifts the mindset from a pursuit of lofty returns to a more structured and emotionally manageable approach to trading.

Additionally, traders are urged to find platforms offering low trading fees since frequent trades can rack up costs, potentially eating into profits. However, focusing on how much can be made rather than getting bogged down by fees is essential for maintaining a profitable outlook.

As a result, developing this compounding strategy equips traders with the tools to harness both market opportunities and their emotional responses, fostering resilience and adaptability in their trading practices. Embracing a methodical plan of trading small gains over time is not only pragmatic but can be a fruitful venture in the dynamic landscape of cryptocurrency.

Navigating Market Fluctuations: Managing Losses

Understanding market fluctuations and navigating losses is crucial for any trader. Developing strategies that help maintain composure during adverse trading conditions is essential for long-term success. A key aspect of this is to recognize market patterns and leverage technical analysis (TA) effectively, without becoming overly dependent on it.

One effective strategy for managing trades, particularly during volatile market conditions, is focused on locking in consistent, small gains rather than aiming for larger, riskier returns. The concept of the “2% strategy” introduced in the discussion revolves around making small, consistent profits across numerous trades. By aiming for gains of around 2-3%, traders can build resilience in their trading approach and cultivate a strategy that allows for incremental profit accumulation. For instance, if you start with $1,000 and successfully make 100 trades netting a 2% gain each time, you could see your initial investment grow significantly due to the power of compounding gains.

This method is not only about securing profit but also about managing losses effectively. For example, when entering a position, using tools like the Lux Algo indicator can provide buy signals that help determine the right entry points. The strategy suggests entering trades when you receive a “green dot” signal on a lower 15-minute chart, particularly focusing on lower-end signals to buy on dips and selling into strengths, usually within that same 2-3% gain range. This pragmatic approach allows traders, especially beginners, to adopt a simple, reachable goal without getting caught up in the complexities of market fluctuations.

When facing losses, it’s crucial to manage emotions. The ability to step back, recognize patterns through charts, and not panic can be transformative. Technical analysis can play a role here; understanding how to read charts, recognizing signals such as Fibonacci retracement levels or market patterns like descending wedges, allows traders to hold their positions instead of selling at a loss. The ability to assess the market condition can be invaluable. For example, a trader might find themselves down $45,000 in a position but, by observing market signals, could recover and sell at a minimal loss.

Additionally, it’s essential to maintain a mindset of continuous learning. As you trade, understanding one pattern or one indicator at a time can help expand your trading knowledge. This gradual accumulation of knowledge equips traders to make informed decisions and enhance their skills over time.

In terms of practical strategies, it’s advisable to also be aware of trading fees, especially with the 2% strategy involving many entries and exits. While fees can add up, focusing on profitability rather than expenses can help maintain a positive trading experience. The goal should always remain on how much can be made rather than how much is spent.

Ultimately, successful trading is about creating a balance: consistently locking in profits while managing losses effectively. Embracing a mindset that focuses on the incremental growth from small gains can pave the way for resilience in trading, especially during periods of market fluctuations that may seem daunting at first. Each trade becomes a learning opportunity, enhancing both your strategy and emotional regulation as you navigate the complexities of trading.

The Importance of Trading Fees

When engaging in cryptocurrency trading, understanding the significance of trading fees is paramount, as they can dramatically impact your overall profitability. While trading, you may come across many exchanges, but selecting one with low trading fees is crucial for maximizing your returns while minimizing costs.

Trading fees can accumulate quickly, especially if you intend to employ strategies that involve making multiple trades, such as the 2% strategy discussed earlier. This strategy operates on compounding small gains repeatedly, which means you would be entering and exiting trades frequently. For example, if you make 100 trades with a 2% target, every time you incur a fee, it eats into your profits. Hence, finding an exchange with lower fees helps enhance your earnings.

Although you might think about how these fees could accumulate, it’s essential to shift your focus towards the bigger picture: the profits you can generate. The speaker notes that they earned $126,900 through 27 trades, emphasizing that when you see substantial profits, the fees may seem less significant in comparison. However, if you are continuously trading, having low fees could mean the difference between a profit margin that is substantial or one that is diminished by excessive costs.

You might wonder about the impact of fees on profitability when employing aggressive trading strategies. Let’s say you start with a $1,000 account and execute your trading strategy successfully. If the exchange charges a 1% trading fee, for every trade you do, that fee will be deducted from your profits. If you’re making small 2% gains and then paying a fee, it could alter your profit to a mere 1% net gain per trade, resulting in a significant annual profit loss over time.

When utilizing platforms for trading, be proactive in researching various exchanges. Look for those that provide competitive fee structures and transparent policies regarding any potential hidden costs. The long-term effect of using an exchange with low fees cannot be understated; not only will it optimize your profits, but it will also give you the ability to engage in more trades without worrying excessively about the fees cutting into your earnings.

Adopting the mindset that trading is a “money-making machine” can help emphasize profitability over trading costs. By focusing on gaining small percentage yields and blocking out the noise of fees, you create an environment for consistent profitability. Hence, consider fees as an operational cost, and choose your platform wisely to maximize your trading efficiency.

To summarize, the choice of an exchange with low trading fees is not just a matter of personal preference, but rather a strategic decision that can enhance your trading results significantly. Always remember to evaluate the financial implications of the fees when determining your strategy, and allow maximum room for profit to flourish.

Building Your Trading Community

Joining a trading community can be one of the most beneficial decisions you make in your trading journey. Platforms like Discord and Patreon provide invaluable opportunities for traders to share ideas, strategies, and support, which can enhance your trading skills and knowledge significantly.

The value in these communities lies in collaborative learning. As you engage with fellow traders, you gain insights into various trading strategies, the nuances of market behavior, and emotional management during trades. For instance, through discussions and shared experiences, you might encounter different perspectives on risk management that lead you to refine your own practices. A community can serve as a sounding board for your thoughts and strategies, helping you to stay informed and motivated.

In trading communities, you often find seasoned traders who are willing to share their experiences, which can prove instrumental in your growth. For example, you could learn about the effective use of tools such as the Lux Algo oscillator Matrix, which many traders use to identify entry and exit points. Such tools can empower you to make data-driven decisions rather than relying solely on intuition.

Moreover, being part of a trading community encourages accountability. When you share your trades and strategies publicly, as done in Discord groups or Patreon memberships, you are more likely to stick to your trading plan. This external accountability can help you avoid emotional trading decisions and promote disciplined trading behavior.

Importantly, while communities provide signals and trade ideas, the intent should not be solely to follow what others do blindly. Instead, engaging with fellow traders allows you to understand the rationale behind their decisions. This learning is crucial in developing your own trading style. For instance, if you observe someone continuously locking in 2-3% gains, you may start to appreciate the effectiveness of such a strategy over chasing larger, riskier returns.

It’s also beneficial to share your progress and the lessons you’re learning in these communities. When you post your trades or reflections on your decision-making processes, you not only contribute to the community but also reinforce your own understanding and accountability. You may find that articulating your thoughts helps you clarify your mind and improve your strategy.

Lastly, always remember to seek out communities that resonate with your goals and values. Whether it’s through a Discord server focused on day trading techniques or a Patreon group sharing news and insights, find a space where you can learn and grow alongside others who are dedicated to improving their trading skills too.

In essence, building your trading community is about enriching your trading experience, developing a support network, and gaining insights that can lead to better trading decisions. Engage actively, stay curious, and leverage the collective knowledge around you to foster your own growth in trading.

Tools Mentioned

In the realm of cryptocurrency trading, having the right tools can significantly influence your trading performance and strategy. This section focuses on two fundamental tools: TradingView and Lux Algo, both of which are essential for charting, analysis, and executing trades efficiently.

TradingView

TradingView is a versatile platform widely used among traders for charting and analysis. It provides a user-friendly interface that allows traders to visualize market trends and make informed decisions. When you create a TradingView account, you gain access to various charting tools, indicators, and the ability to share analyses with the community. To effectively utilize TradingView, you will need to set up your account and familiarize yourself with its features, including different chart types, drawing tools, and custom indicators.

Once you have your TradingView account, you can integrate it with Lux Algo, which enhances your trading experience further by providing advanced analytical tools and indicators.

Lux Algo

Lux Algo is an indicator plugin designed to work seamlessly with TradingView. This tool has gained popularity among traders due to its reliability and the various features it offers. With over 50,000 users, Lux Algo is considered a trusted partner for many traders. Subscribers have the option to choose between monthly or annual plans, with the recommendation to start with a monthly subscription to gauge its effectiveness before switching to an annual plan where you can save up to 40%.

The key feature of Lux Algo is the Oscillator Matrix, which acts as a comprehensive trading indicator. This matrix alerts traders to potential buy and sell opportunities, helping streamline decision-making when entering or exiting trades. When you subscribe to Lux Algo, included instructions guide you through linking it to TradingView. You’ll navigate to the “Indicator” section, select “Invite-only Scripts,” and activate the Oscillator Matrix, leading to a pop-up chart where signals for trading are displayed.

Lux Algo provides multiple tools within its offering, but the Oscillator Matrix is notably effective, particularly for executing trades based on green dot prints on a 15-minute chart. This feature assists traders in identifying optimal entry points and fosters a disciplined approach by encouraging users to buy during market dips and sell into price strength. Whether you are a seasoned trader or a beginner, these indicators can enhance your ability to evaluate market conditions.

In summary, TradingView acts as the foundational platform for charting, while Lux Algo delivers the necessary indicators that refine your trading strategy. Utilizing these tools effectively can help you develop skills that allow for systematic trading, ultimately increasing your chances of profits in the volatile world of cryptocurrency. By mastering TradingView and Lux Algo, traders can make informed decisions that align with their specific trading strategies.